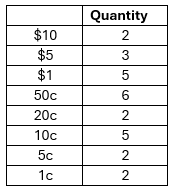

A company’s petty cash book is operated

using the imprest system. The imprest amount is $100. At the

end of a week, the petty cash remaining was made up as follows:

Assuming

there were no errors or discrepancies, what is the amount which should

be withdrawn from the bank account to restore the petty cash balance?

Enter your answer to 2 decimal places.